Disclaimer: The content provided in this article is intended for general informational purposes only and should not be construed as financial advice. The analysis presented is based on cyclical patterns in historical data, which may not be applicable to specific financial situations or investment decisions. Readers are advised to conduct their own research and consult with qualified financial professionals before making any investment or business choices. The author and Cycle Quest shall not be held responsible for any losses, damages, or liabilities resulting from the use of the information presented in this article. Additionally, past performance or historical trends are not indicative of future results. Individual circumstances and market conditions may vary, so exercise caution and judgment when applying the insights discussed in this article.

Among all the commodities that traders like to trade, oil is certainly one of the most volatile and closely watched. The price of crude oil has a significant impact on the global economy and affects industries such as transportation, manufacturing, and energy production. But what if we told you that we can help you predict the crude oil price with a high level of accuracy using cycles? Read on to learn more and understand all you need to know about the price of a barrel of oil!

Which Factors Affect the Oil Price? Summarizing Global Oil Markets

The crude oil price is affected by various factors that can cause fluctuations in its value. These include:

- Geopolitical tensions: Any political instability or conflicts in major oil-producing countries can disrupt supply and cause prices to rise. In these cases, oil producers can also choose to intervene on the supply (for instance, they may reduce oil production, which leads us to the next point).

- Demand and supply: As with any commodity, changes in oil supply and demand can have a direct impact on the oil price. Global oil demand growth or a decrease in supply can lead to a rise in prices, while a decrease in demand or an increase in supply can lead to a drop in prices.

- Economic factors: Oil is also a great indicator for economists in general. The state of the global economy and GDP growth rates can also play a role in oil price changes. A healthy economy typically leads to higher oil demand, resulting in higher prices.

- Weather conditions: Extreme weather events such as hurricanes, floods, or severe winters can impact oil production and transportation, causing short-term price spikes.

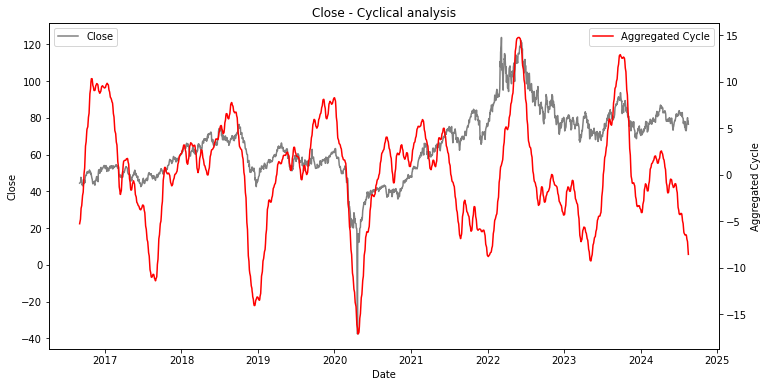

The (Obvious to See) Cyclic Nature of the Crude Oil Price

If we apply our cycle analysis algorithm to the historical WTI price (this could work on brent price analysis, or on shale oil, or on any oil price index), it is easy to see how cyclical this market is. The chart below shows in black the historical WTI prices, and in red the detected cycles. This is not magic or guesswork – it is a result of advanced mathematical analysis applied to historical data.

This simplified chart makes it clear that oil prices move in repetitive patterns, with peaks and troughs occurring at relatively regular intervals. Understanding these cyclical movements can give traders an edge in predicting future price changes and making more informed trading decisions.

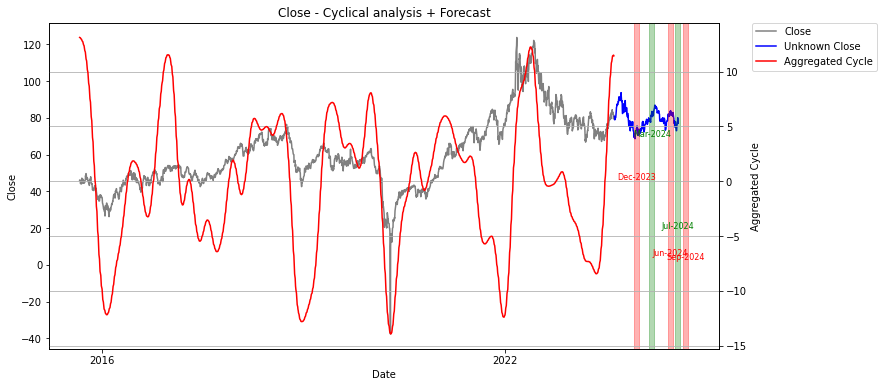

A Past Oil Price Forecast – The Proof that Cycle Analysis Works with a Past Prediction for 2024

We don’t like empty talks, so let us show you what cycle analysis would have told us in terms of energy outlook in the past. In Summer 2023, our cycle analysis algorithm predicted that the crude oil price would experience a bottom in December 2023, followed by a peak in March 2024 and another bottom with lower prices in June 2024. As shown in the chart below, this prediction was remarkably accurate, with only a slight difference of one month for the last bottom.

It is important to note that while cycle analysis can provide highly accurate predictions, it is still a statistical tool and, therefore, subject to some margin of error when trying to predict the oil price per barrel. This margin increases with time as cycles are dynamic and constantly evolving. That is why we always recommend performing and re-performing cycle analysis over time to stay on top of market movements.

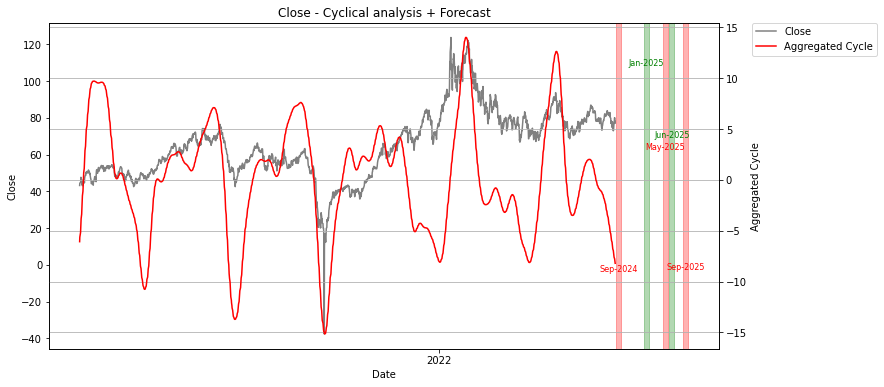

What About the Future of Energy Prices? Our Latest Oil Price Prediction (Toward 2025 and Beyond)

Now, let’s look at our latest oil price prediction based on cycle analysis. According to our algorithm, it is fair to assume that the crude oil price will bottom in September 2024 and peak in January 2025. This means we can expect a slight dip in prices towards the end of 2024, followed by an increase at the beginning of 2025.

Could this tool be used to for more long-term predictions, like oil price in 2030? Yes, but we’d suggest to run and rerun the analysis over time, as cycles are dynamic.

This information on future oil prices is typically only available to our clients, but today we’re making an exception and sharing it with you for free!

Let Us Help You Understand What Oil Prices May Do with Cycle Analysis

At Cycle Quest, we have developed an advanced cycle analysis algorithm that can help you predict and time the market with a high level of accuracy. Our algorithm is continuously refined to adapt to market conditions, giving our clients an edge in their trading strategies.

The idea is to use cycles to forecast global oil prices and understand where supply and demand see oil over the next years. We focus on light sweet crude oil and aim to provide insights into how prices could trend.

Contact us today to learn more about how our cycle analysis can help you forecast oil prices and benefit your trading decisions in the crude oil market.

Frequently Asked Questions About Oil Prices Forecasts

What is the significance of a crude oil price forecast?

A crude oil price forecast helps investors, traders, and companies make informed decisions by predicting future prices based on various factors affecting the oil market, including global demand, supply, and geopolitical events.

How do oil futures relate to the crude oil price forecast?

Oil futures are contracts that allow investors to buy or sell oil at a predetermined price in the future. They are heavily influenced by the crude oil price forecast, as traders use predictions to speculate on future price movements.

What factors affect the price of crude oil?

Multiple factors affect the price of crude oil, including global oil production, demand for oil, geopolitical tensions, and economic indicators. Events that impact these factors can lead to a price drop or an increase in the brent crude oil price.

How can I access the latest oil forecast?

You can access the latest oil forecast through reports from organizations like the Energy Information Administration, which provides regular updates on global oil demand, production, and pricing trends.

What role does WTI crude play in the oil market?

WTI crude oil serves as one of the main benchmarks for oil pricing in the United States. Its price often influences the brent crude oil price and is crucial for assessing the overall health of the oil market.

How does global oil consumption impact the crude oil price forecast?

Global oil consumption significantly impacts the crude oil price forecast, as increased demand can lead to higher prices, while reduced consumption can contribute to falling prices, affecting both brent and WTI oil prices.

What is the relationship between crude oil production and oil prices?

Crude oil production levels directly influence oil prices. When production increases and exceeds demand, prices tend to fall. Conversely, if production is reduced, prices may rise due to limited supply in the oil market.

How do oil inventories affect oil prices?

Oil inventories reflect the supply levels in the market. When global oil inventories decrease, it often indicates tightening supply, which can lead to higher oil prices. Conversely, increasing inventories may suggest surplus supply, potentially leading to a price drop.

Why should investors consider long-term oil forecasts?

Long-term oil forecasts provide insights into potential future pricing trends based on anticipated changes in global oil demand, production, and consumption patterns. This information helps investors make strategic decisions regarding investments in oil companies and commodities.