Disclaimer: The content provided in this article is intended for general informational purposes only and should not be construed as financial advice. The analysis presented is based on cyclical patterns in historical data, which may not be applicable to specific financial situations or investment decisions. Readers are advised to conduct their own research and consult with qualified financial professionals before making any investment or business choices. The author and Cycle Quest shall not be held responsible for any losses, damages, or liabilities resulting from the use of the information presented in this article. Additionally, past performance or historical trends are not indicative of future results. Individual circumstances and market conditions may vary, so exercise caution and judgment when applying the insights discussed in this article.

One of the few sure things in the global economy is the role that gold plays as a store of value and hedge against inflation. As such, the price of gold is closely monitored by investors, traders, and governments alike. But with so many factors influencing its price, it can be difficult to predict where it will go in the next 5 years. Cycle analysis can help you make sense of the ups and downs in the gold market, giving you a better understanding of where its price could be headed, let us show you how it works.

Which Factors Affect Gold Price?

The price of gold is influenced by a multitude of factors that reflect both economic conditions and market psychology. Understanding these elements is crucial for investors and enthusiasts alike, as they provide insights into how and why gold prices fluctuate.

- Inflation: One of the primary factors affecting gold prices is inflation. As inflation rises, the purchasing power of currency diminishes, prompting investors to seek refuge in tangible assets. Gold has historically been viewed as a safe-haven asset, meaning that when inflation rates climb, more investors flock to gold to preserve their wealth. This increased demand can subsequently drive up gold prices.

- Recession Fears: Recession fears also play a significant role in the gold market. During uncertain economic times, such as recessions or periods of financial instability, many investors look for stable investments. Gold has proven to be a reliable store of value during these turbulent times, which is why its price often rises when economic outlooks are grim. The tendency to gravitate toward gold in these circumstances highlights its role as a financial safety net.

- Interest Rates: Interest rates are another critical factor impacting gold prices. When interest rates are low, the opportunity cost of holding gold decreases. Investors are less likely to miss out on returns from interest-bearing assets like bonds or savings accounts when rates are low, making gold a more attractive option. Conversely, when interest rates increase, gold may lose some of its appeal, as investors might prefer assets that yield higher returns.

- Supply and Demand Dynamics: Supply and demand dynamics inherently influence the price of gold as well. The amount of gold being mined and traded in the market directly affects availability. If gold mining output decreases due to geopolitical issues or environmental regulations, the limited supply can lead to price increases. Additionally, demand for gold jewelry, industrial applications, and investment purposes can create fluctuations in price based on consumer behavior.

- Geopolitical Events: Lastly, geopolitical events such as political tensions, wars, and global conflicts can have immediate impacts on the gold market. In times of crisis, investors often turn to gold as a safe-haven asset, driving up its price. This reaction to global events underscores the interconnectedness of geopolitical stability and economic security.

The price of gold is shaped by a complex interplay of factors, including inflation, recession fears, interest rates, supply and demand, and geopolitical events. Each of these elements contributes to the broader narrative of gold as a timeless and significant asset in the financial world. Understanding these influences can aid investors in making informed decisions regarding their investments in gold.

Understanding Gold Price Today to Make a Better Forecast Tomorrow

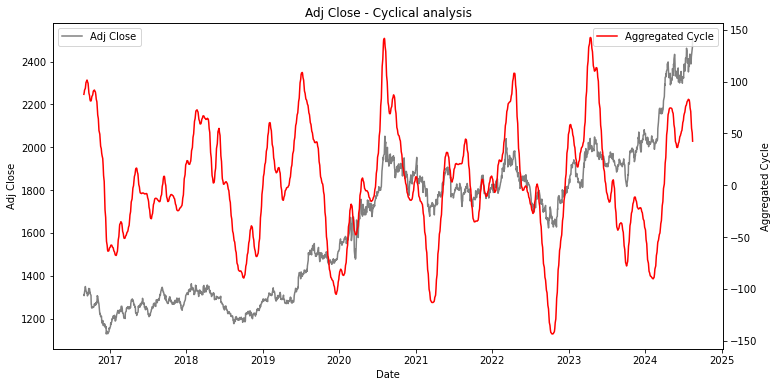

It’s important to note that these factors tend to move in cycles. This means that the price of gold itself should also exhibit cyclical behavior. Looking at historical data, we can see this cyclic pattern with peaks and troughs over time.

The chart above shows you the historical gold price (in black) and the detected cycle (in red). The peaks and bottoms are really easy to see.

The Proof that Cycle Analysis Works – A Past Price Forecast Example for the Average Price of Gold

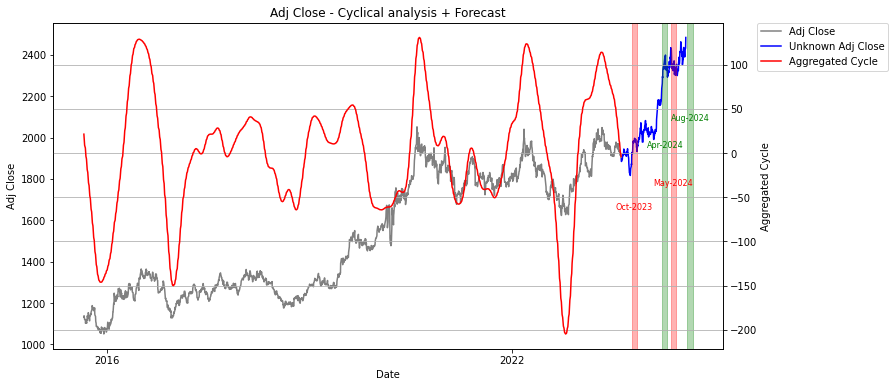

A real-life example of this can be seen in our gold price forecast for 2024. In Summer 2023, gold prices were around $1,900, and our cyclic analysis indicated several key predictions for gold:

Here is what the chart above tells you in terms of prediction (note: the blue line represents data points that were not known to the model at the time of the forecast):

- A downward cyclic phase was expected to peak in October 2023.

- Gold is predicted to reach a peak in April 2024, with a possible rise in price as we approach November 2024.

- A rapid decline is anticipated in May 2024, followed by new highs in the second half of 2024.

While these predictions for 2024 were not perfect, they provide valuable insights for traders looking to better understand gold price movements. If trends continue, gold could be worth significantly more by the end of 2024, potentially influencing portfolios with gold and driving the appetite for gold as a reliable store of value.

Any central bank buying of gold could also affect the price of gold, keeping gold prices elevated and contributing to future price gains. Gold has shown itself to be prone to big price swings, but the overall forecast for gold remains optimistic as we look towards the future.

Our Gold Price Forecast for the Next Years

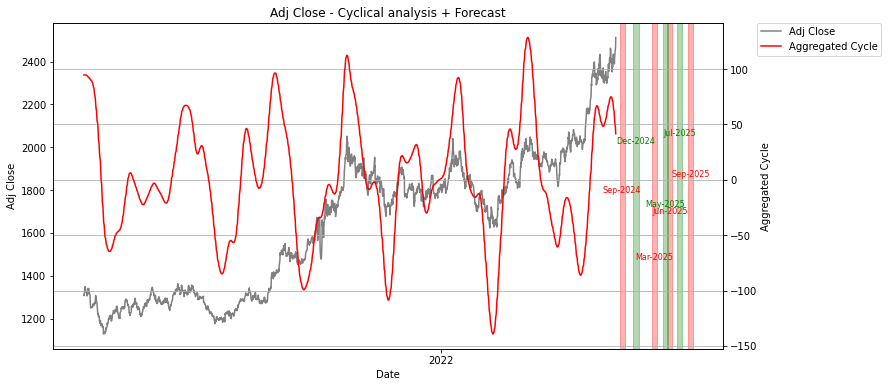

Based on our cycle analysis, we can make a prediction for the next 5 years regarding gold prices:

Here is what cycle analysis tells us, based on the chart above:

- We may face a bottom in September 2024, followed by a peak in December 2024.

- We’ll likely see a bottom in March 2025.

It’s important to note that this is just an initial forecast, and we will continue to run our cycle analysis periodically to update and adjust these predictions as needed.

As we look ahead, the value of gold is expected to rise, with gold prices predicted to hit highs in 2024. Gold is also known as a safe haven, and many investors are considering buying gold to safeguard their assets.

With gold prices continuing to fluctuate, it’s essential to stay informed about price predictions for gold. As we approach the last quarter of 2024, it’s crucial to monitor how the oil price and the US consumer price index might drive gold price trends.

In summary, forecasting gold movements and understanding the physical gold market will be key for anyone looking to invest. The gold standard remains strong, and gold reserves could play a significant role in the gold bull market ahead.

Get Your Own Cycle Analysis Advice Today (for Gold Forecast and More)

If you’re interested in utilizing cycle analysis to make more informed decisions about your investments, contact Cycle Quest today. Our team of experts can assist with analyzing cycles on any asset, including gold. Don’t rely on guesswork when it comes to your investments, trust in the power of cycle analysis.

What is the current gold price prediction for the next quarter?

The current gold price prediction for the next quarter suggests a potential increase due to ongoing economic uncertainties and high gold demand, as analyzed by various market experts and Cycle Quest.

How do interest rates affect the gold price?

Interest rates have a significant impact on gold prices. When interest rates rise, the opportunity cost of holding precious metals increases, which can lead to a decrease in gold demand and subsequently lower prices. Conversely, lower interest rates often result in higher gold prices as investors seek safe-haven assets.

Can you explain the factors that affect the price forecast of gold?

Several factors affect the price forecast of gold, including inflation rates, currency strength, geopolitical tensions, and shifts in gold demand. Understanding these variables helps in making informed predictions about future gold prices.

What has been the trend in gold prices over the past year?

Over the past year, gold prices have shown volatility, hitting both all-time highs and lows. Investors closely monitor these trends to inform their decisions regarding physical gold and other precious metals like silver.

What is the forecast for gold prices in the next five years?

The long-term forecast for gold prices suggests they may rise due to increasing gold demand and potential economic instability. Analysts predict that gold could be worth significantly more as market cycles evolve.

How can I predict gold prices accurately?

To predict gold prices accurately, one should analyze market trends, historical data, and economic indicators. Tools like technical analysis and understanding the impact on gold prices from global events can enhance the prediction for gold.

Will silver prices impact gold price predictions?

Yes, silver prices can impact gold price predictions. As gold and silver often move in tandem, changes in silver prices can influence investor sentiment and lead to fluctuations in gold demand and price movements.

What is the relationship between gold demand and gold price forecasting?

Gold demand is a crucial component in gold price forecasting. Higher demand typically leads to increased prices, while lower demand can result in price drops. Analysts use gold demand trends to refine their price forecasts.

What are the implications of record gold prices on the market?

Record gold prices can attract more investors seeking safe-haven assets, which may further drive up prices. Additionally, it can prompt discussions about the future of gold and its role in investment portfolios.

Why do investors and traders like gold?

Traders and investors often see gold as a safe-haven asset due to its ability to retain value during times of economic instability. It is also seen as a hedge against inflation and currency devaluation.