Disclaimer: The content provided in this article is intended for general informational purposes only and should not be construed as financial advice. The analysis presented is based on cyclical patterns in historical data, which may not be applicable to specific financial situations or investment decisions. Readers are advised to conduct their own research and consult with qualified financial professionals before making any investment or business choices. The author and Cycle Quest shall not be held responsible for any losses, damages, or liabilities resulting from the use of the information presented in this article. Additionally, past performance or historical trends are not indicative of future results. Individual circumstances and market conditions may vary, so exercise caution and judgment when applying the insights discussed in this article.

One of the main debates on the financial markets is “What will the Fed do?” Will it raise interest rates? Will it cut interest rates? How will this affect my investments? And since everyone is entitled to an opinion, we can find economists arguing opposite sides. However, let’s try to go beyond opinions and observe the cycles that are clearly at play in the Federal Reserve’s interest rate decisions. Today, we will show you how analyzing these cycles can be a powerful tool for investors.

How Does the Fed Interest Rate Impact Wall Street?

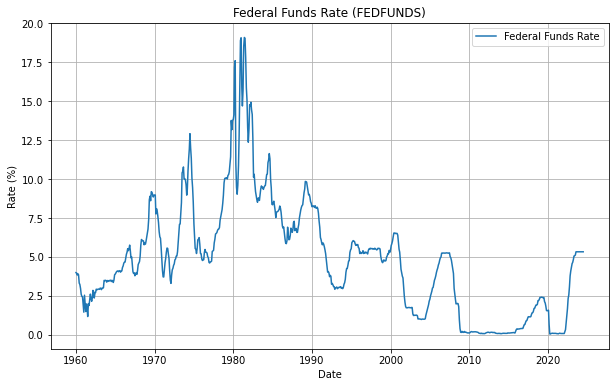

The Federal Reserve, also known as the “Fed”, has a dual mandate of maintaining price stability and maximizing employment. One of the tools it uses to achieve this is through setting the federal funds rate, which is the interest rate at which banks lend money to each other overnight, which follows the path shown below:

This rate influences various borrowing costs throughout the economy and ultimately impacts Wall Street by affecting stock prices, bond yields, and currency exchange rates.

Rate Cut vs Rate Hike – How Does the Market Respond to a Central Bank Rate Change?

The market’s reaction to a change in interest rates is never easy to understand. A strong rate cut may lead investors to believe we are facing a recession, with capital fleeing the stock market to enter the bond one. A slight rate cut may convey the message that the FOMC (Federal Open Market Committee) is simply controlling inflation and has managed to reduce it. The same goes for rate hikes: a strong, sudden hike can lead investors to conclude that inflation risk is very high in the economy, while a small one may indicate that the economy is growing strong and the Fed is just keeping inflation under control. This is not a rule, but let us sum it up as follows:

- Strong rate cuts can signal economic weakness

- Small rate cuts can indicate controlled inflation (unless inflation is close to 0% or even below 0%)

- Strong rate hikes can suggest increased inflation risk

- Small rate hikes can signify a thriving economy (unless inflation appears to be out of control)

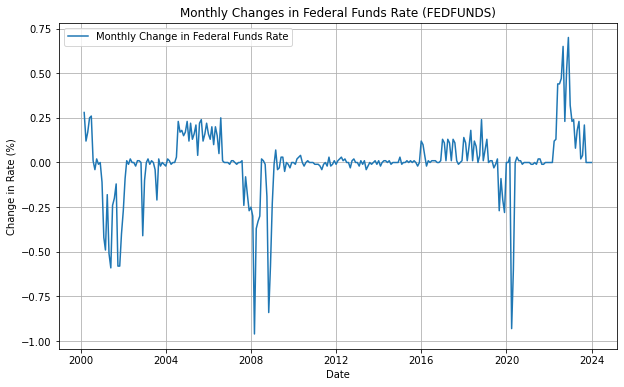

A Look at the Cycles Involved in the Federal Reserve Rates

When we perform cycle analysis on the monthly rate changes, it becomes evident that the Fed’s interest rates have a strongly cyclical component. This is clearly shown when observing a chart of the federal funds rate over time:

In general, the Fed maintains steady rates for extended periods and only makes changes when necessary. Now imagine taking a pen and extending the cyclic curve in the chart above. This would make for a nice forecast tool, right? This is exactly what we do at Cycle Quest, as we tell you below.

A Past Prediction on FOMC Decisions on Interest Rates

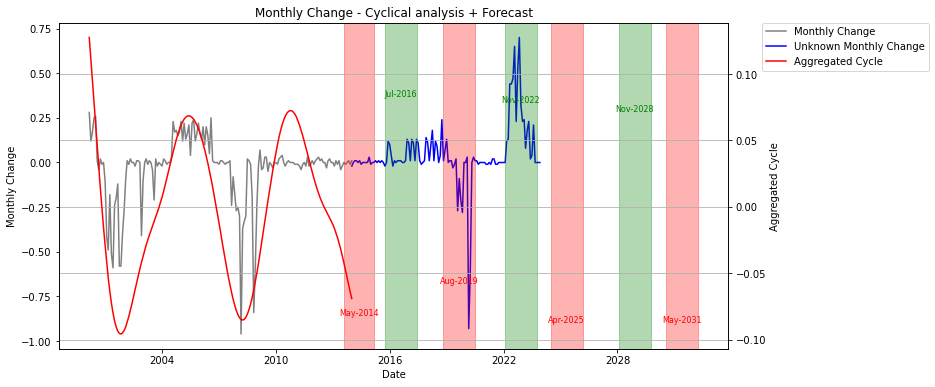

Let’s look at a past example. In 2014, cycle analysis predicted several key events regarding interest rates:

Here is how you should read the chart: the black line represents the historical interest rates we were aware of in 2014. The blue line are the actual interest rates, that we could not possibly know at the time of our prediction. The red and green areas represent, respectively, the bottoms and tops of the predicted cycles.

Specifically, this was our prediction:

- A low for interest rates in May 2014

- A rate hike phase beginning in 2016

- A rate cut period in the second half of 2019

- A rate hike phase at the end of 2022

How accurate were these predictions? As it turns out, they were quite impressive. The low for interest rates did occur around May 2014, and a series of rate hikes did begin in 2016. The COVID-19 pandemic resulted in a delay for the expected rate cut in late 2019, but ultimately pushed the FOMC to cut rates in early 2020. And as predicted, the Fed began raising rates again at the end of 2022.

Note that, being a statistical model, these are not 100% accurate predictions, and the farther we go in the future, the bigger the uncertainty margin. However, they give a clear hint about what to expect.

Will the Fed Hold Rates Steady in the Future?

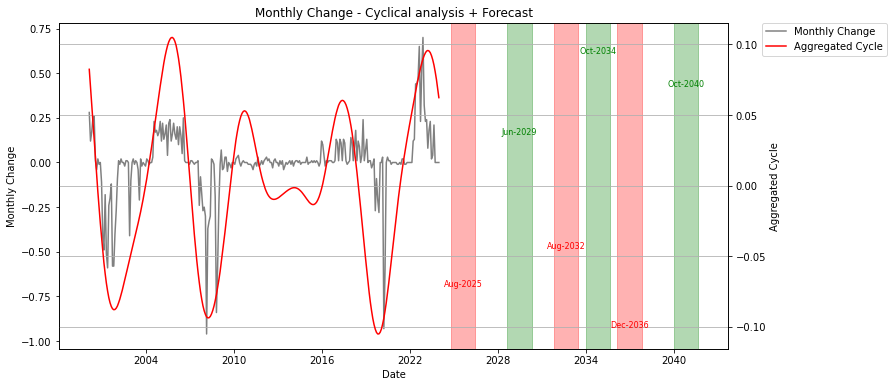

If we look at the cycles in the current scenario, we obtain the prediction below:

Specifically, it is fair to assume an interest rates bottoming out in August 2025, followed by a gradual increase until November 2027. We would not consider any prediction beyond November 2027 as robust because, as we have told you many times in the past, cycles are dynamic, and cycle analysis must be repeated over time. The closer we get to the end of the predicted cycle, the more accurate our forecasts become.

Interested in Cycle Analysis on Federal Funds Rates?

If you like this kind of analysis and want to learn more about how we use cycles in our trading strategies, be sure to contact us. Perhaps your portfolio needs a cycle analysis upgrade, and our team at Cycle Quest can help you add this type of analysis to your investment skillset.

FAQ About Predicting Federal Funds Rates

How do Federal Reserve cycles impact mortgage rates?

Federal Reserve cycles can directly influence mortgage rates as changes in the central bank’s policy rates can lead to fluctuations in the interest rates offered on mortgages.

What is the significance of the Fed meeting in relation to interest rates?

The Fed meeting plays a crucial role in setting monetary policy and determining interest rates for the year 2024 based on economic conditions.

Will the Federal Open Market Committee (FOMC) cut interest rates in 2024-2025?

Yes, cycle analysis validates the likelihood of the FOMC to cut interest rates in 2024 until Summer 2025.

How does the Federal Reserve Chair, Jerome Powell, influence interest rate policies?

As the head of the Federal Reserve, Jerome Powell plays a key role in determining the direction of interest rates through his leadership and decision-making within the FOMC.

What are market expectations for the next Fed meeting?

The Federal Reserve observes cycles in unemployment and inflation rates within the US economy. Cycle analysis can easily predict these patterns.

How likely are rate cuts in 2024-2025 according to current Fed projections?

Rate cuts in 2024-2025 are likely based on assessments made by the current Fed officials considering economic conditions, inflation rates, and employment data.