Disclaimer: The content provided in this article is intended for general informational purposes only and should not be construed as financial advice. The analysis presented is based on cyclical patterns in historical data, which may not be applicable to specific financial situations or investment decisions. Readers are advised to conduct their own research and consult with qualified financial professionals before making any investment or business choices. The author and Cycle Quest shall not be held responsible for any losses, damages, or liabilities resulting from the use of the information presented in this article. Additionally, past performance or historical trends are not indicative of future results. Individual circumstances and market conditions may vary, so exercise caution and judgment when applying the insights discussed in this article.

Anyone able to predict the way US treasury yields evolve over time can proudly call themselves a successful investor. The US Treasury yield is a key indicator of the economy’s health and has implications for both domestic and global markets. In fact, you could even argue that whatever happens in the US has a ripple effect on the rest of the world, as it is home to the world’s largest economy and most widely-used currency.

First Things First: Why Does the US Treasury Yield Matter?

US treasury yields matter because they are closely tied to interest rates. As interest rates rise, bond prices fall (it is fair to say that this is the #1 rule in financial markets), making bonds less attractive to investors. This can have a cascading effect on other securities and asset classes, potentially leading to a recession.

In addition, changes in US treasury yields can also impact currency exchange rates, which further affects global markets. Essentially, the US treasury yield serves as a benchmark for interest rates and can have far-reaching implications on the overall economy.

From Inflation to Recession Risk: The Factors that Move US Treasury Yields

There are several factors that influence US treasury yields. These include inflation expectations, economic growth forecasts, and Federal Reserve policies. Ultimately, the goal of the Federal Reserve is to maintain stable prices and promote maximum employment in the US.

To achieve this, they may adjust interest rates (also known as the “fed funds rate”) by cutting or raising them, which in turn affects bond yields. Economic data such as inflation rates and GDP growth also play a role in determining future monetary policy decisions.

A Different Perspective on Bond Yield Prediction: Cycle Analysis

At Cycle Quest, we take a different approach to predicting US treasury yields. Instead of delving into complex economic data and uncovering market trends, we use cycle analysis to forecast future movements in bond yields.

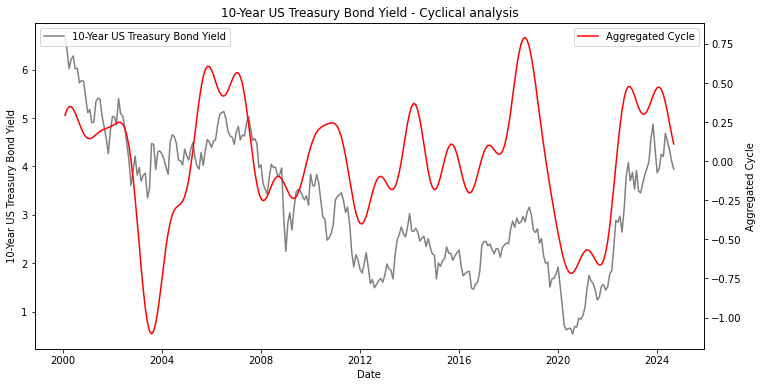

This means we look at the cyclical patterns of the past to identify potential trends for the future. As seen in the chart below, the US Treasury yield has clear cycles that can be identified using this method:

The black line represents the actual US treasury yield over time, while the red line shows our detected cycle activity. By extending this aggregated cycle, we can make predictions for future tops and bottoms in yields.

The Proof That It Works: A Look at a Past Prediction

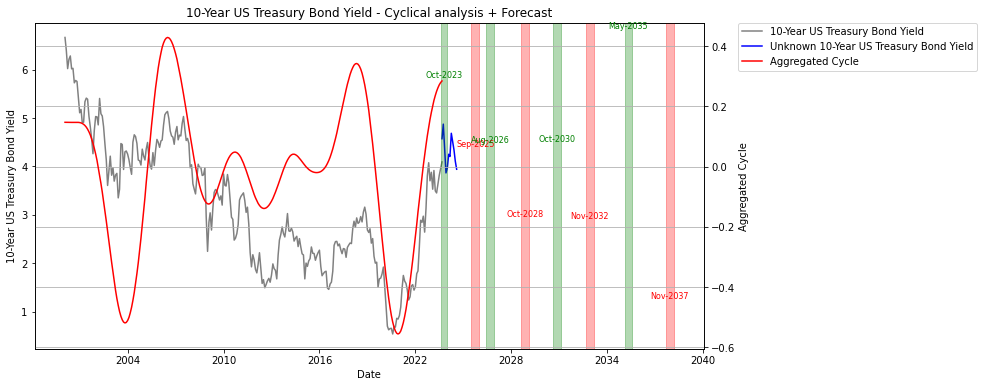

To demonstrate its effectiveness, let’s look at a prediction made by our model in August 2023 when economists and investors were wondering if the 10-year yield could go even higher (as a reminder for you, the yield was above 5%). Our cycle analysis actually predicted a peak in the Summer of 2023, as shown in the image below:

This prediction proved to be accurate, with the actual yield following a similar pattern (keep in mind: the blue line data were not known to the model at the time of the prediction). So, when economists were wondering whether yields had peaked in May 2023, the answer was: “Yes, the peak is happening as we speak.”

Treasury Note Forecast with Cycles

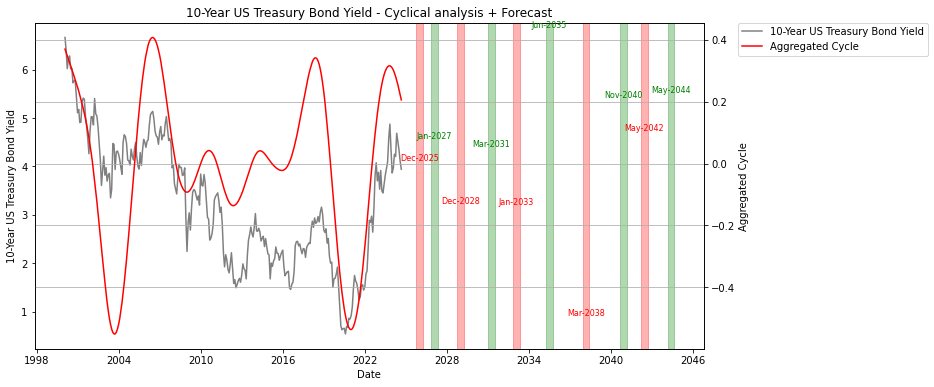

As part of our mission to provide valuable insights to investors, we are sharing our forecast for US treasury yields using cycle analysis. Take note that 1) this is just an example and should not be considered as financial advice and 2) this is premium content we normally share with our clients, but we’re making an exception in this free-to-read article for the sake of education.

As you can see below, our model predicts a potential bottom in December 2025 followed by a peak in January 2027.

Contact Us to Get Help Running Your Own Analysis

Interested in running your own analysis using cycle analysis? Contact us for personalized support and guidance. Our team of experts can help you understand the complexities of the bond market and provide insights tailored to your investment goals.

FAQ on 10 Year Treasury Forecast

How do Federal Reserve interest rate decisions impact the yield curve?

Federal reserve interest rate decisions directly impact the yield curve by influencing the yields on treasury securities. When the fed rate is cut, yields on longer-term bonds like the 10-year treasury typically decrease, which can flatten or invert the yield curve.

What is the significance of rate cuts this year for the bond market?

Rate cuts this year by the federal reserve can lead to lower yields on treasury bonds and notes, affecting the overall bond market. Investors might see a rise in demand for fixed income securities like municipal bonds and treasury inflation protected securities as yields decrease.

What is the yield on the 10-year treasury and how is it forecasted?

The yield on the 10-year treasury is a critical indicator of investor sentiment and economic expectations. Forecasts for the 10-year treasury yield consider current market data, economic conditions, and anticipated federal reserve rate cuts, which could influence the yield in the coming months.

How do treasury yield forecasts affect fixed income investments?

Treasury yield forecasts can significantly affect fixed income investments. As yields are expected to fluctuate, investors may alter their strategies regarding treasury bonds, treasury bills, and other fixed income assets, potentially seeking higher yields or adjusting their portfolios in anticipation of interest rate changes.

What are the implications of a flattening yield curve?

A flattening yield curve indicates that the difference between short-term and long-term interest rates is decreasing. This often suggests that investors expect slower economic growth or potential interest rate cuts from the federal reserve, which can influence decisions on purchasing treasury securities and other bonds.

How do rate cuts impact the treasury inflation protected securities?

Rate cuts can lead to reduced yields on treasury inflation protected securities (TIPS), making them less attractive compared to other fixed income options. However, TIPS may still be appealing to investors looking for protection against inflation, especially if the federal reserve signals continued economic uncertainty.

What role do basis points play in treasury yield forecasts?

Basis points are used to measure changes in interest rates and yields. In treasury yield forecasts, a change of even a few basis points can indicate significant shifts in the bond market, reflecting investor expectations about future federal reserve rate cuts and overall economic conditions.

What is the 10-year note yield and why is it important?

The 10-year note yield is the return on investment for a 10-year treasury bond. It is important because it serves as a benchmark for other interest rates, influences mortgage rates, and reflects investor confidence in the economy. Changes in the 10-year note yield can signify shifts in economic outlook and monetary policy expectations.