Disclaimer: The content provided in this article is intended for general informational purposes only and should not be construed as financial advice. The analysis presented is based on cyclical patterns in historical data, which may not be applicable to specific financial situations or investment decisions. Readers are advised to conduct their own research and consult with qualified financial professionals before making any investment or business choices. The author and Cycle Quest shall not be held responsible for any losses, damages, or liabilities resulting from the use of the information presented in this article. Additionally, past performance or historical trends are not indicative of future results. Individual circumstances and market conditions may vary, so exercise caution and judgment when applying the insights discussed in this article.

In the dynamic world of finance, anticipating the behavior of the VIX indicator holds immense significance for traders and investors alike. Predicting intraday peaks in the VIX can offer valuable insights into market sentiment and potential volatility.

In a previous article, we explored the power of cyclical analysis and its ability to forecast panic moments in the VIX index. Now, with the benefit of hindsight, we can verify the accuracy of our prediction and celebrate a successful call.

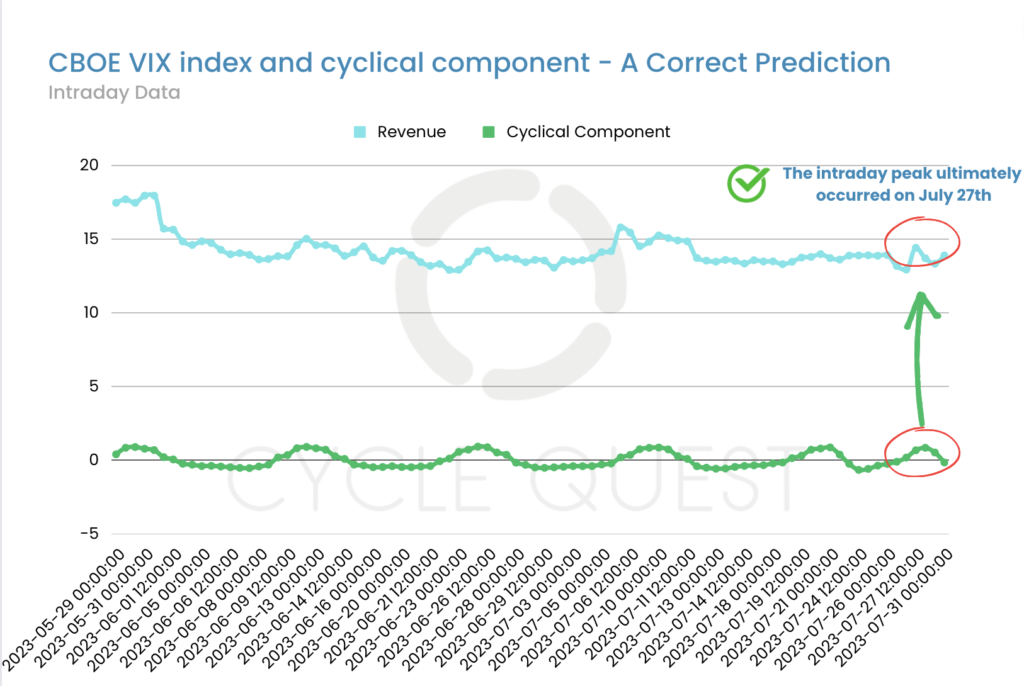

Utilizing cyclical analysis, a successful prediction was made for an intraday peak in the VIX index between July 24th and July 28th. This peak was confirmed on July 27th, demonstrating the effectiveness of this analytical approach.

This accurate forecast highlights the potential of cyclical analysis as a powerful tool for anticipating market movements. It can offer valuable insights, enabling informed decision-making and risk management in the ever-fluctuating financial landscape.

Cycle Quest continues to provide personalized cyclical analysis services across various sectors, including business, investments, sports, and science. By leveraging cyclical analysis, individuals and organizations can uncover hidden patterns in their data, gain a competitive edge, and optimize their strategies. Contact us today to learn how Cycle Quest can help you make better decisions.

Table of Contents

Importance of Predicting the VIX Indicator Behavior

The VIX, also known as the “investor fear gauge,” measures market volatility and plays a crucial role in gauging investor sentiment. Anticipating intraday peaks in the VIX provides traders with essential information to make well-timed decisions, offering opportunities to capitalize on market movements and effectively manage risk.

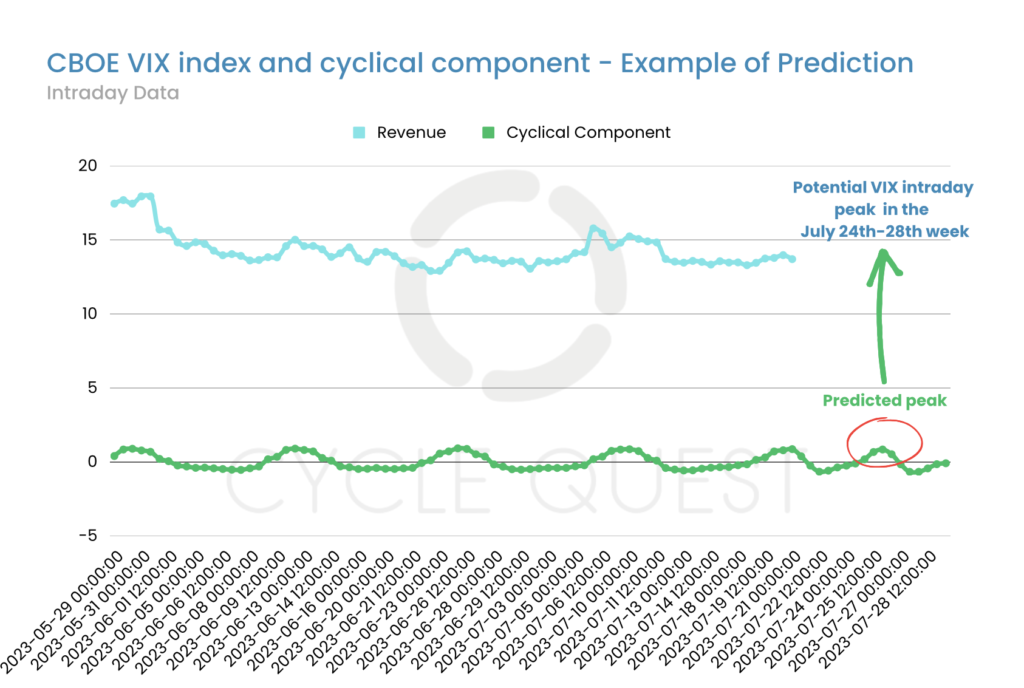

In our previous article, we utilized cyclical analysis to predict an intraday peak in the VIX index between July 24th and July 28th. Let’s revisit the chart that depicted this prediction:

Actual Values and the Confirmed Peak on July 27th

As we fast-forward to the present, we are pleased to share that our prediction has proven accurate. On July 27th, the VIX index recorded a peak value of 14.5 points, validating the significance of cyclical analysis in anticipating market movements.

An Amazing Opportunity with Cycle Quest

The successful prediction of the VIX intraday peak underscores the prowess of cyclical analysis. At Cycle Quest, we continue to offer personalized cyclical analysis services tailored to your specific needs. Whether you are in business, investments, sports, or science, our team of knowledgeable advisors can guide you in unraveling hidden cyclical patterns within your data.

By harnessing the power of cyclical analysis, you can gain a competitive edge and optimize your strategies. Don’t miss out on the valuable insights cyclical analysis can provide – reach out to Cycle Quest today and unlock the potential for informed decision-making in the ever-evolving financial landscape.

In conclusion, our successful prediction of the VIX intraday peak validates the importance of cyclical analysis in understanding financial market movements. As we celebrate this achievement, we invite you to explore the possibilities with Cycle Quest and discover how cyclical analysis can empower you on your journey to success.

Cycle Quest – Your Partner in Cyclical Analysis

Cycle Quest provides bespoke cyclical analysis services designed to meet the requirements of businesses, investors, and those eager to learn. They have a team of expert advisors, each specializing in different sectors, guaranteeing proficiency in identifying and evaluating top-quality datasets.

Here’s a quick three-step guide you should familiarize yourself with before reaching out to Cycle Quest:

Reach out to us and delve into exemplary instances of cyclical analysis utilization in varied sectors such as commerce, finance, sports, and scientific research. With Cycle Quest, discover concealed cyclical trends in your data, empowering you to get a leg up on the competition and fine-tune your strategies.